from Business News: Latest News on Business, Stock Markets, Financial News, India Business & World Business News https://ift.tt/34thufF

Equity indices started on a positive note on Thursday with the benchmark BSE sensex rising over 450 points in opening trade led by gains across sectors, amid positive global cues. The 30-share BSE index was trading 461 points or 1.21 per cent higher at 38,529; while the broader NSE Nifty was up 129 points or 1.15 per cent at 11,377.

Equity indices started on a positive note on Thursday with the benchmark BSE sensex rising over 450 points in opening trade led by gains across sectors, amid positive global cues. The 30-share BSE index was trading 461 points or 1.21 per cent higher at 38,529; while the broader NSE Nifty was up 129 points or 1.15 per cent at 11,377. Search engine giant Google has sent notices to online food delivery platforms Swiggy and Zomato for gamification and promotions related to IPL matches, which led to the offers being taken down.

Search engine giant Google has sent notices to online food delivery platforms Swiggy and Zomato for gamification and promotions related to IPL matches, which led to the offers being taken down. IECC comes under the ‘red’ category of subsidiaries, which means that the beneficiaries of the resolution process will be its largest lenders. These include SBI, ICICI Bank and IL&FS Group. The company has an outstanding debt of Rs 4,700 crore, part of which is owed to the promoter group.

IECC comes under the ‘red’ category of subsidiaries, which means that the beneficiaries of the resolution process will be its largest lenders. These include SBI, ICICI Bank and IL&FS Group. The company has an outstanding debt of Rs 4,700 crore, part of which is owed to the promoter group. Public sector Punjab National Bank (PNB) on Wednesday declared its Rs 1,203.26 crore exposure to Sintex Industries Ltd as fraud.Pursuant to the applicable provisions of Sebi's Listing Obligations and Disclosure Requirements (LODR) and the bank's policy, "we inform reporting of borrowal fraud of Rs 1,203.26 crore in NPA account of Sintex Industries Ltd (SIL)," PNB said in a regulatory filing.

Public sector Punjab National Bank (PNB) on Wednesday declared its Rs 1,203.26 crore exposure to Sintex Industries Ltd as fraud.Pursuant to the applicable provisions of Sebi's Listing Obligations and Disclosure Requirements (LODR) and the bank's policy, "we inform reporting of borrowal fraud of Rs 1,203.26 crore in NPA account of Sintex Industries Ltd (SIL)," PNB said in a regulatory filing. Shareholders of Thrissur-based Dhanlaxmi Bank have voted out the Reserve Bank of India (RBI)-approved MD & CEO Sunil Gurbaxani at its annual general meeting on Wednesday. A filing by the bank said that 90.5% of the shareholders voted against the appointment.

Shareholders of Thrissur-based Dhanlaxmi Bank have voted out the Reserve Bank of India (RBI)-approved MD & CEO Sunil Gurbaxani at its annual general meeting on Wednesday. A filing by the bank said that 90.5% of the shareholders voted against the appointment. Iconic US fashion brand GAP is breaking away from its India franchise partner Arvind Fashions, three sources aware of the matter said. This is one of the first casualties in fashion retail due to Covid and may lead to GAP’s exit from India or a significantly reduced presence here, the sources said.

Iconic US fashion brand GAP is breaking away from its India franchise partner Arvind Fashions, three sources aware of the matter said. This is one of the first casualties in fashion retail due to Covid and may lead to GAP’s exit from India or a significantly reduced presence here, the sources said. The government on Wednesday acknowledged for the first time that it will fall short of the disinvestment target as it deferred the BPCL bid submission deadline for the fifth time, while retaining the annual borrowing target at the revised level of Rs 12 lakh crore.

The government on Wednesday acknowledged for the first time that it will fall short of the disinvestment target as it deferred the BPCL bid submission deadline for the fifth time, while retaining the annual borrowing target at the revised level of Rs 12 lakh crore. In a case covering several financial years, the Mumbai bench of the Income Tax Appellate Tribunal (ITAT) has struck down the action of the I-T officer in treating $3 million — with which a Swiss bank account was opened — as “unaccounted income” in the hands of an individual, who at that point of time was a non-resident.

In a case covering several financial years, the Mumbai bench of the Income Tax Appellate Tribunal (ITAT) has struck down the action of the I-T officer in treating $3 million — with which a Swiss bank account was opened — as “unaccounted income” in the hands of an individual, who at that point of time was a non-resident. The income tax (I-T) department on Tuesday evening said payment gateways facilitating e-commerce transactions don’t need to deduct taxes if the e-commerce platform has deducted it already. For proper implementation, e-tailers and payment gateways may have an understanding on the same, the Central Board of Direct Taxes (CBDT) circular said.

The income tax (I-T) department on Tuesday evening said payment gateways facilitating e-commerce transactions don’t need to deduct taxes if the e-commerce platform has deducted it already. For proper implementation, e-tailers and payment gateways may have an understanding on the same, the Central Board of Direct Taxes (CBDT) circular said. Reliance Jio, the country’s largest telecom operator, has written to the Prime Minister’s Office (PMO) and the telecom ministry, alleging that “vested interests” are holding back spectrum sale worth nearly Rs 4 lakh crore, which is leading to poor services for the consumers and depriving the exchequer of much-needed cash.

Reliance Jio, the country’s largest telecom operator, has written to the Prime Minister’s Office (PMO) and the telecom ministry, alleging that “vested interests” are holding back spectrum sale worth nearly Rs 4 lakh crore, which is leading to poor services for the consumers and depriving the exchequer of much-needed cash. Shapoorji Pallonji and Company, the SP Group flagship, has formally written to banks for a restructuring of its loan obligations under the special Covid scheme announced by the Reserve Bank of India (RBI). This is the first large account of over Rs 1,500 crore to come up for restructuring and is likely to be referred to the K V Kamath-led committee, which will vet all restructuring proposals of over Rs 1,500 crore.

Shapoorji Pallonji and Company, the SP Group flagship, has formally written to banks for a restructuring of its loan obligations under the special Covid scheme announced by the Reserve Bank of India (RBI). This is the first large account of over Rs 1,500 crore to come up for restructuring and is likely to be referred to the K V Kamath-led committee, which will vet all restructuring proposals of over Rs 1,500 crore. Markets regulator Sebi on Tuesday made it mandatory for all listed entities to disclose to the stock exchanges any forensic audit that a company carries out. The entity is also required to intimate to the exchanges when a forensic audit is initiated, the regulator said after its board meeting earlier in the day.

Markets regulator Sebi on Tuesday made it mandatory for all listed entities to disclose to the stock exchanges any forensic audit that a company carries out. The entity is also required to intimate to the exchanges when a forensic audit is initiated, the regulator said after its board meeting earlier in the day.|

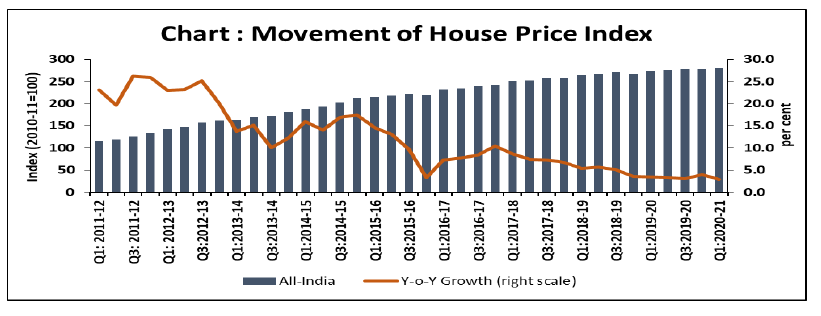

Today, the Reserve Bank released its quarterly house price index (HPI)1 (base: 2010-11=100) for Q1:2020-21, based on transaction level data received from housing registration authorities in ten major cities (viz., Ahmedabad, Bengaluru, Chennai, Delhi, Jaipur, Kanpur, Kochi, Kolkata, Lucknow and Mumbai). Time series on all-India and city-wise HPI are available at the Bank’s Database of Indian Economy (DBIE) portal (https://dbie.rbi.org.in/DBIE/dbie.rbi?site=statistics > Real Sector > Price & Wages > Quarterly). Highlights:

(Yogesh Dayal) Press Release: 2020-2021/407 1 Compiled in the Department of Statistics and Information Management, Reserve Bank of India. Reference may be made to the article “House Price Index: 2010-11 to 2013-14” in October 2014 issue of the RBI Bulletin (weblink: https://www.rbi.org.in/Scripts/BS_ViewBulletin.aspx) for HPI compilation methodology. |

Reliance Industries Limited (RIL) on Wednesday announced that New York-based General Atlantic will invest Rs 3,675 crore for a 0.84 per cent stake in its retail arm -- Reliance Retail Ventures Limited (RRVL) -- making it the latest in a series of investments at the oil-to-telecoms conglomerate.

Reliance Industries Limited (RIL) on Wednesday announced that New York-based General Atlantic will invest Rs 3,675 crore for a 0.84 per cent stake in its retail arm -- Reliance Retail Ventures Limited (RRVL) -- making it the latest in a series of investments at the oil-to-telecoms conglomerate.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

So far, 48 sections of the Act have been decriminalised and 23 of the remaining 66 compoundable offences can be dealt with by an in-house adjudicating mechanism. Total penal provisions under the Act have been brought down to 124 from 134 earlier. Fines for various offences have also been brought down in the latest set of changes.

So far, 48 sections of the Act have been decriminalised and 23 of the remaining 66 compoundable offences can be dealt with by an in-house adjudicating mechanism. Total penal provisions under the Act have been brought down to 124 from 134 earlier. Fines for various offences have also been brought down in the latest set of changes. Singapore state investor Temasek, hedge fund Tybourne Capital and former US vice-president Al Gore’s Generation Investment Management are among the potential new backers for Bigbasket. The online grocer is looking to mop up $350-400 million in a new round of funding, said two sources familiar with the development.

Singapore state investor Temasek, hedge fund Tybourne Capital and former US vice-president Al Gore’s Generation Investment Management are among the potential new backers for Bigbasket. The online grocer is looking to mop up $350-400 million in a new round of funding, said two sources familiar with the development. Twitter Inc appointed Rinki Sethi, a former information security executive at IBM, as its chief information security officer, the social media company said on Monday. Sethi had previously worked as the vice president of information security at cyber-security firm Palo Alto Networks Inc, according to her LinkedIn profile.

Twitter Inc appointed Rinki Sethi, a former information security executive at IBM, as its chief information security officer, the social media company said on Monday. Sethi had previously worked as the vice president of information security at cyber-security firm Palo Alto Networks Inc, according to her LinkedIn profile. The three-member committee comprising Lakshmi Vilas Bank (LVB) directors is working on a rights issue, which is expected in a couple of months, while pursuing Clix Capital’s proposal for acquiring a stake in the southern lender.

The three-member committee comprising Lakshmi Vilas Bank (LVB) directors is working on a rights issue, which is expected in a couple of months, while pursuing Clix Capital’s proposal for acquiring a stake in the southern lender. The country’s residential real estate market has shown initial signs of a pick-up during the July-September quarter, with sales rising 34% compared to the June quarter, although it was still 65% lower than the second quarter of 2019-20.

The country’s residential real estate market has shown initial signs of a pick-up during the July-September quarter, with sales rising 34% compared to the June quarter, although it was still 65% lower than the second quarter of 2019-20. Paytm on Monday evening said its cricket league cashbacks through the Unified Payments Interface (UPI) is now back on its app after it made changes to the programme. In the current version, a user will have to submit all his stickers to claim a cashback. In the earlier version, the user had the option to choose a select number of stickers from the total number for the cashback.

Paytm on Monday evening said its cricket league cashbacks through the Unified Payments Interface (UPI) is now back on its app after it made changes to the programme. In the current version, a user will have to submit all his stickers to claim a cashback. In the earlier version, the user had the option to choose a select number of stickers from the total number for the cashback.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Many Indian companies with foreign subsidiaries whose directors or senior executives are stranded in India due to the pandemic are now worried that they may have domestic tax implications under the place of effective management (PoEM) rule.

Many Indian companies with foreign subsidiaries whose directors or senior executives are stranded in India due to the pandemic are now worried that they may have domestic tax implications under the place of effective management (PoEM) rule. Three of Apple Inc's top contract manufacturers plan to invest a total of almost $900 million in India in the next five years to tap into a new production-linked incentive plan, according to two sources familiar with the matter.

Three of Apple Inc's top contract manufacturers plan to invest a total of almost $900 million in India in the next five years to tap into a new production-linked incentive plan, according to two sources familiar with the matter. The Reserve Bank of India (RBI) on Monday said that the three-day monetary policy committee (MPC) meeting scheduled to commence from September 29 to review the central bank’s benchmark repo rate has been postponed. Without attributing any reason for the rescheduling, the RBI said that the new dates will be announced soon.

The Reserve Bank of India (RBI) on Monday said that the three-day monetary policy committee (MPC) meeting scheduled to commence from September 29 to review the central bank’s benchmark repo rate has been postponed. Without attributing any reason for the rescheduling, the RBI said that the new dates will be announced soon. Shareholders of Lakshmi Vilas Bank, led by institutions, unexpectedly voted against the appointment of Sundar as chief executive as well as the reappointment of six other directors on Friday. Shareholders alleged that part of the accountability for the bank’s deteriorating performance over the past few years rested with them.

Shareholders of Lakshmi Vilas Bank, led by institutions, unexpectedly voted against the appointment of Sundar as chief executive as well as the reappointment of six other directors on Friday. Shareholders alleged that part of the accountability for the bank’s deteriorating performance over the past few years rested with them. Shareholders of Lakshmi Vilas Bank, led by institutions, unexpectedly voted against the appointment of Sundar as chief executive as well as the reappointment of six other directors on Friday. Shareholders alleged that part of the accountability for the bank’s deteriorating performance over the past few years rested with them.

Shareholders of Lakshmi Vilas Bank, led by institutions, unexpectedly voted against the appointment of Sundar as chief executive as well as the reappointment of six other directors on Friday. Shareholders alleged that part of the accountability for the bank’s deteriorating performance over the past few years rested with them. The three Chinese banks to whom Anil Ambani owes more than $716 million (Rs 5,276 crore), as well as significant legal costs, have decided to pursue their rights against him on his worldwide assets, following the beleaguered Reliance Group chairman’s English high court cross-examination on Friday.

The three Chinese banks to whom Anil Ambani owes more than $716 million (Rs 5,276 crore), as well as significant legal costs, have decided to pursue their rights against him on his worldwide assets, following the beleaguered Reliance Group chairman’s English high court cross-examination on Friday. The three Chinese banks to whom Anil Ambani owes more than $716 million (Rs 5,276 crore), as well as significant legal costs, have decided to pursue their rights against him on his worldwide assets, following the beleaguered Reliance Group chairman’s English high court cross-examination on Friday.

The three Chinese banks to whom Anil Ambani owes more than $716 million (Rs 5,276 crore), as well as significant legal costs, have decided to pursue their rights against him on his worldwide assets, following the beleaguered Reliance Group chairman’s English high court cross-examination on Friday. Equity indices opened on a positive note on Monday with the benchmark BSE sensex rising over 350 points amid positive global cues. The 30-share BSE sensex was trading 359 points or 0.96 per cent higher at 37,748; while the broader NSE Nifty was 107 points or 0.97 per cent up at 11,157.

Equity indices opened on a positive note on Monday with the benchmark BSE sensex rising over 350 points amid positive global cues. The 30-share BSE sensex was trading 359 points or 0.96 per cent higher at 37,748; while the broader NSE Nifty was 107 points or 0.97 per cent up at 11,157. Typically, it is the Reserve Bank of India (RBI) governor who is at the centre of attention ahead of the Monetary Policy Committee (MPC) meeting. But this time, all eyes are on the Capital’s Raisina Hill as the central bank awaits clarity on the government’s nominees on the crucial panel that decides the trajectory of interest rates.

Typically, it is the Reserve Bank of India (RBI) governor who is at the centre of attention ahead of the Monetary Policy Committee (MPC) meeting. But this time, all eyes are on the Capital’s Raisina Hill as the central bank awaits clarity on the government’s nominees on the crucial panel that decides the trajectory of interest rates. After months of speculation if the RBI will directly buy government bonds from the secondary market, the central bank looks to have settled it. In the week ended September 20, the RBI purchased government securities (G-Secs) worth nearly Rs 6,900 crore from the secondary market. This is its biggest weekly direct market purchase ever, excluding the open market operations (OMOs), which are done on a pre-planned basis.

After months of speculation if the RBI will directly buy government bonds from the secondary market, the central bank looks to have settled it. In the week ended September 20, the RBI purchased government securities (G-Secs) worth nearly Rs 6,900 crore from the secondary market. This is its biggest weekly direct market purchase ever, excluding the open market operations (OMOs), which are done on a pre-planned basis. The three Chinese banks to whom Anil Ambani owes more than $716 million (Rs 5,276 crore), as well as significant legal costs, have decided to pursue their rights against him on his worldwide assets, following the beleaguered Reliance Group chairman’s English high court cross-examination on Friday.

The three Chinese banks to whom Anil Ambani owes more than $716 million (Rs 5,276 crore), as well as significant legal costs, have decided to pursue their rights against him on his worldwide assets, following the beleaguered Reliance Group chairman’s English high court cross-examination on Friday.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

With an eye on entering mobile manufacturing, Reliance Industries may acquire United Telelinks or forge a contract-manufacturing deal, sources said. Questions sent to Reliance Industries remained unanswered. Jio Platforms, the telecom and technology arm of Reliance Industries, has received funding from top global private equity and internet giants, including Facebook and Google.

With an eye on entering mobile manufacturing, Reliance Industries may acquire United Telelinks or forge a contract-manufacturing deal, sources said. Questions sent to Reliance Industries remained unanswered. Jio Platforms, the telecom and technology arm of Reliance Industries, has received funding from top global private equity and internet giants, including Facebook and Google. Bank credit growth continues to lag with loans outstanding yet to reach end-March 2020 levels even as deposits continue to surge, growing 5% during the current fiscal up to September 11. This is likely to keep deposit rates under check despite the RBI holding back on rate cuts due to rising inflation.

Bank credit growth continues to lag with loans outstanding yet to reach end-March 2020 levels even as deposits continue to surge, growing 5% during the current fiscal up to September 11. This is likely to keep deposit rates under check despite the RBI holding back on rate cuts due to rising inflation. Anush Raghavan, Senior Vice-President and Head – Cash Business Unit of the CMS said that with a network spanning over 115,000 ATMs and retail outlets that spread across 98.3 per cent of districts in India, the company is uniquely positioned as the "backbone of the circulation cycle" of the economy.

Anush Raghavan, Senior Vice-President and Head – Cash Business Unit of the CMS said that with a network spanning over 115,000 ATMs and retail outlets that spread across 98.3 per cent of districts in India, the company is uniquely positioned as the "backbone of the circulation cycle" of the economy. In its last MPC meeting in August, RBI kept policy rates unchanged to help tame inflation that in recent times had surged past 6 per cent mark, and said the economy is in an extremely weak condition following the pandemic. The RBI has cut policy rates by 115 basis points since February.

In its last MPC meeting in August, RBI kept policy rates unchanged to help tame inflation that in recent times had surged past 6 per cent mark, and said the economy is in an extremely weak condition following the pandemic. The RBI has cut policy rates by 115 basis points since February. "Each ministry has been sent those sectors to identify their response. What incentives they (sectors) need, what policy tweaking is required, they (respective ministries) should do that. We have given them a preliminary action plan and the ministries will work on that. Each ministry will bring its own policy on these sectors," the commerce and industry ministry official said.

"Each ministry has been sent those sectors to identify their response. What incentives they (sectors) need, what policy tweaking is required, they (respective ministries) should do that. We have given them a preliminary action plan and the ministries will work on that. Each ministry will bring its own policy on these sectors," the commerce and industry ministry official said. The fund infusion would be for meeting regulatory capital requirements if the need arises in October-December quarter. In 2019-20, the government infused Rs 70,000 crore into PSBs to boost credit for a strong impetus to the economy.

The fund infusion would be for meeting regulatory capital requirements if the need arises in October-December quarter. In 2019-20, the government infused Rs 70,000 crore into PSBs to boost credit for a strong impetus to the economy. Voting results released late on Saturday night showed that seven of the ten directors proposed to be reappointed by the bank in its 93rd annual general meeting (AGM) held on Friday were rejected by the shareholders by a comfortable majority of more than 60% of votes polled.

Voting results released late on Saturday night showed that seven of the ten directors proposed to be reappointed by the bank in its 93rd annual general meeting (AGM) held on Friday were rejected by the shareholders by a comfortable majority of more than 60% of votes polled. "Maharashtra produces 90 to 100 lakh tonnes of sugar every year. We are moving ahead to cut the production by 10 lakh tonnes every year, and take up ethanol production and provide it to petroleum companies," Maharashtra State Co-operative Sugar Factories Federation Chairman Jayprakash Dandegaonkar said.

"Maharashtra produces 90 to 100 lakh tonnes of sugar every year. We are moving ahead to cut the production by 10 lakh tonnes every year, and take up ethanol production and provide it to petroleum companies," Maharashtra State Co-operative Sugar Factories Federation Chairman Jayprakash Dandegaonkar said. The fund infusion would be for meeting regulatory capital requirements if the need arises in October-December quarter. In 2019-20, the government infused Rs 70,000 crore into PSBs to boost credit for a strong impetus to the economy.

The fund infusion would be for meeting regulatory capital requirements if the need arises in October-December quarter. In 2019-20, the government infused Rs 70,000 crore into PSBs to boost credit for a strong impetus to the economy. Voting results released late on Saturday night showed that seven of the ten directors proposed to be reappointed by the bank in its 93rd annual general meeting (AGM) held on Friday were rejected by the shareholders by a comfortable majority of more than 60% of votes polled.

Voting results released late on Saturday night showed that seven of the ten directors proposed to be reappointed by the bank in its 93rd annual general meeting (AGM) held on Friday were rejected by the shareholders by a comfortable majority of more than 60% of votes polled. "This is a new retail price intervention mechanism which has been approved by the Group of Ministers recently. Under this initiative, the central government will provide processed moong and urad to state governments either in bulk quantity or in one or half kilo pack for retail sale," Consumer Affairs Secretary Leena Nandan said.

"This is a new retail price intervention mechanism which has been approved by the Group of Ministers recently. Under this initiative, the central government will provide processed moong and urad to state governments either in bulk quantity or in one or half kilo pack for retail sale," Consumer Affairs Secretary Leena Nandan said.