India will need to increase its labour force participation rate (LFPR) by providing greater opportunities to its working population especially women.

India will need to increase its labour force participation rate (LFPR) by providing greater opportunities to its working population especially women.from Economy-News-Economic Times https://ift.tt/2SzJuXT

via

Ajit Prasad Press Release : 2018-2019/1011 |

||||||||||||

|

The Reserve Bank of India has imposed a monetary penalty of ₹50,000/- (Rupees Fifty Thousand only) on the Dr. Ambedkar Nagrik Sahakari Bank Maryadit, Gwalior, Madhya Pradesh in exercise of the powers vested in it under the provisions of Section 47A(1)(c) read with Section 46(4) of the Banking Regulation Act, 1949 (As Applicable to Co-operative Societies) for violation of the provisions of Section 27 of Banking Regulation Act, 1949 (As Applicable to Co-operative Societies) and restrictions imposed upon it under Supervisory Action Framework. The Reserve Bank of India had issued a show cause notice to the bank, in response to which the bank submitted a written reply. After considering the facts of the case, the bank’s reply in the matter and personal hearing, the Reserve Bank of India came to the conclusion that the violations were substantiated and warranted imposition of penalty. Ajit Prasad Press Release : 2018-2019/1008 |

Tensions between the RBI and the government have spilled into the public domain after deputy governor Viral Acharya said last week that undermining central bank independence could be “potentially catastrophic”.

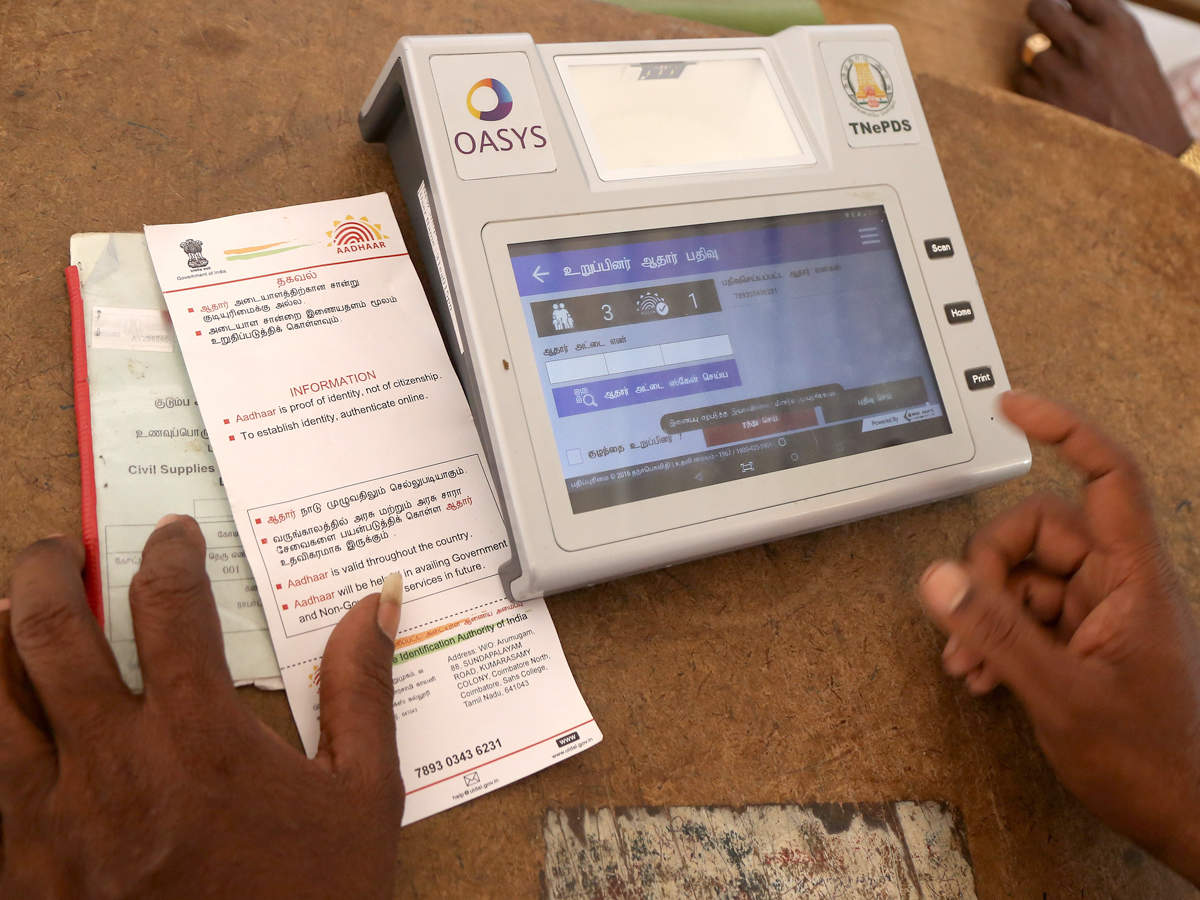

Tensions between the RBI and the government have spilled into the public domain after deputy governor Viral Acharya said last week that undermining central bank independence could be “potentially catastrophic”. In the first official confirmation about the mega project in the offing, Pandey said: "With Aadhaar Seva Kendras, we are building hassle-free and resident-friendly enrolment and update facility infrastructure to ensure ease in Aadhaar related services to residents".

In the first official confirmation about the mega project in the offing, Pandey said: "With Aadhaar Seva Kendras, we are building hassle-free and resident-friendly enrolment and update facility infrastructure to ensure ease in Aadhaar related services to residents".|

The Government of India has announced the sale (issue/re-issue) of Government Stock detailed below through auctions to be held on November 2, 2018. As per revised scheme of underwriting notified on November 14, 2007, the amounts of Minimum Underwriting Commitment (MUC) and the minimum bidding commitment under Additional Competitive Underwriting (ACU) for the underwriting auction, applicable to each Primary Dealer (PD), are as under:

The underwriting auction will be conducted through multiple price based method on November 1, 2018 (Thursday). PDs may submit their bids for ACU auction electronically through Core Banking Solution (E- Kuber) System between 10.30 a.m. and 12.00 noon on the date of underwriting auction. The underwriting commission will be credited to the current account of the respective PDs with RBI on the date of issue of securities. Ajit Prasad Press Release : 2018-2019/1007 |

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The result of the RBI Fixed Rate Reverse Repo Operations held on October 30, 2018 is as under:

Ajit Prasad Press Release: 2018-2019/1005 |

||||||||||||||||||||||||

|

Based on an assessment of prevailing liquidity conditions and also of the durable liquidity needs going forward, the Reserve Bank has decided to conduct purchase of the following Government securities under Open Market Operations for an aggregate amount of ₹ 120 billion on November 01, 2018 (Thursday) through multi-security auction using the multiple price method:

There is an overall aggregate ceiling of ₹ 120 billion for all the securities in the basket put together. There is no security-wise notified amount. RBI reserves the right to:

The eligible participants should submit their offers in electronic format on the Reserve Bank of India Core Banking Solution (E-Kuber) system between 10.30 a.m. and 12.00 noon on November 01, 2018 (Thursday). Only in the event of system failure, physical offers would be accepted. Such physical offer should be submitted to Financial Markets Operations Department (Please click here to send email; Phone no: 022-22630982) in the prescribed form obtainable from RBI website (https://www.rbi.org.in/Scripts/BS_ViewForms.aspx) before 12.00 noon. The result of the auction will be announced on the same day and payment to successful participants will be made during banking hours on November 02, 2018 (Friday). Successful participants should ensure availability of requisite amount of securities in their SGL account by 12 noon on November 02, 2018 (Friday). Ajit Prasad Press Release : 2018-2019/1004 |

|

The Reserve Bank of India has today released the data on External Commercial Borrowings (ECB), Foreign Currency Convertible Bonds (FCCB) and Rupee Denominated Bonds (RDB) both, through Automatic Route and Approval Route, for the month of September 2018. Ajit Prasad Press Release: 2018-2019/1003 |

|

The Reserve Bank today released data on India’s invisibles as per the IMF’s Balance of Payments and International Investment Position Manual (BPM6) format for April-June of 2018-19. Ajit Prasad Press Release: 2018-2019/1002 |

There has been an irreversible breakdown between the RBI Governor Urjit Patel and the government, the report further stated, adding that all options were on the table.

There has been an irreversible breakdown between the RBI Governor Urjit Patel and the government, the report further stated, adding that all options were on the table. Deshpande, who joined Cognizant as an architect in 1999, went on to head the BFS product solutions business and incubated it in emerging markets. He was also the delivery head for the infrastructure services business and played a key role in Cognizant’s $2.7-billion acquisition of Trizetto.

Deshpande, who joined Cognizant as an architect in 1999, went on to head the BFS product solutions business and incubated it in emerging markets. He was also the delivery head for the infrastructure services business and played a key role in Cognizant’s $2.7-billion acquisition of Trizetto. Infosys, Yes Bank, HDFC, Vedanta amd Mahindra and Mahindra were among the major gainers on the BSE index, rising as much as 2.27 per cent. On NSE, sub-indices Nifty IT and PSU Bank surged the most by gaining as much as 1.26 per cent.

Infosys, Yes Bank, HDFC, Vedanta amd Mahindra and Mahindra were among the major gainers on the BSE index, rising as much as 2.27 per cent. On NSE, sub-indices Nifty IT and PSU Bank surged the most by gaining as much as 1.26 per cent. Urjit Patel had come to attend a routine meeting of the Financial Stability and Development Council, headed by the finance minister. The exit was carefully planned as Patel took the side gate out of North Block, where his car was waiting for him. But unlike their boss, the deputy governors chose to take the main door, although none of them spoke to reporters.

Urjit Patel had come to attend a routine meeting of the Financial Stability and Development Council, headed by the finance minister. The exit was carefully planned as Patel took the side gate out of North Block, where his car was waiting for him. But unlike their boss, the deputy governors chose to take the main door, although none of them spoke to reporters. These projects involved investment of at least Rs 14,000 crore, sources in the National Highways Authority of India (NHAI) said. IL&FS representatives said they would soon appoint a professional for valuation of the completed stretches to assess how much they can get from selling these revenue generating projects.

These projects involved investment of at least Rs 14,000 crore, sources in the National Highways Authority of India (NHAI) said. IL&FS representatives said they would soon appoint a professional for valuation of the completed stretches to assess how much they can get from selling these revenue generating projects. The withdrawal limit has been curtailed on Classic and Maestro debit cards, held by a large number of the bank customers. However, customers with other variants of SBI debit card can continue to enjoy higher daily withdrawal from ATMs.

The withdrawal limit has been curtailed on Classic and Maestro debit cards, held by a large number of the bank customers. However, customers with other variants of SBI debit card can continue to enjoy higher daily withdrawal from ATMs. A plan to be presented to a bankruptcy court on Wednesday by the state-appointed board of the lender includes selling the entire stake to a financially strong investor and ensure business continuity. Other options include splitting businesses according to verticals and disposing them off to several buyers or injecting liquidity at group level.

A plan to be presented to a bankruptcy court on Wednesday by the state-appointed board of the lender includes selling the entire stake to a financially strong investor and ensure business continuity. Other options include splitting businesses according to verticals and disposing them off to several buyers or injecting liquidity at group level. Reserve Bank governor Urjit Patel said the liquidity problem in NBFCs is not as severe as is being projected, but assured the government that it would ensure adequate liquidity in the system, sources said after the meeting.

Reserve Bank governor Urjit Patel said the liquidity problem in NBFCs is not as severe as is being projected, but assured the government that it would ensure adequate liquidity in the system, sources said after the meeting.